Types of Insurance Policies Business in India Pages in category "Types of insurance" The following 91 pages are in this category, out of 91 total. This list may not reflect recent changes ().

What Are the Six Principles of Insurance? Sapling.com

Life Insurance Types and Features - HDFC Life. Pages in category "Types of insurance" The following 91 pages are in this category, out of 91 total. This list may not reflect recent changes ()., When taking out insurance, policyholders often think more about their own needs than the risk the insurer takes on. But the insurer is all too aware of it. For that reason, there are six principles in place that guide all insurance companies as they make decisions about the policies they grant..

insurance into a matter of real urgency. Insurance has developed exponentially since then and is now a highly complex and sophisticated response to risk. However, six core principles have been established over time – many of which have been upheld by the Courts or codified by Acts of Parliament. study material professional programme insurance lawinsurance law and and practicepracticepractice module 3 elective paper 9.3 icsi house, 22, institutional area, lodi road, new delhi 110 003

Types of Insurance Companies: Insurance companies can be categorized into two main divisions which are as follows: General Insurance Companies: These companies provide all types of insurance such as automobile, homeowner’s policies and many more. However, they do not cover life insurance. Two general types are available: term insurance Life insurance with a death benefit but no accumulated savings. provides coverage only during the term of the policy and pays off only on the insured’s death; whole-life insurance Provides savings as well as insurance and can let the insured collect before death. provides savings as well as

terms are also listed out. An overview of major life insurance and general insurance products is included as well. Contents Chapter 1: Risk Management: Provides an understanding of risk management - different types of risks - actual and consequential losses – management of risks – loss minimization techniques. 2. Insurance - Classification of Insurance 1. Classification of Insurance• Life Insurance• Non Life Insurance 2. Classification of Insurance - Life• Life Insurance – It is a contract between the insured person and the company or "carrier" that is providing the insurance.

What is General Insurance? A general insurance is a contract that offers financial compensation on any loss other than death. It insures everything apart from life. A general insurance compensates you for financial loss due to liabilities related to your house, car, bike, health, travel, etc. The insurance company promises to pay you a sum The two basic types of life insurance are Traditional Whole Life and Term Life.Simply explained, Whole Life is a policy you pay on until you die and Term Life is a policy for a set amount of time.

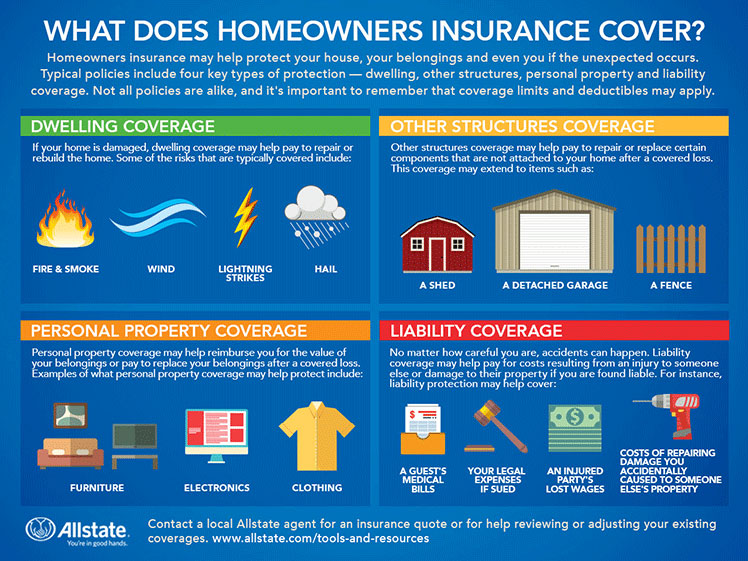

In the United States, the most common types of personal insurance are homeowners, auto, health and life. Some types of insurance are required by law, such as auto insurance. The biggest advantage of insurance is that it serves as a hedge against future losses, but … study material professional programme insurance lawinsurance law and and practicepracticepractice module 3 elective paper 9.3 icsi house, 22, institutional area, lodi road, new delhi 110 003

General Insurance in other words is a non-life insurance which insures everything excluding life. Health, Holiday, Accident, Travel, Mortgage Protection, etc are some of the aspects that General Insurance covers. As compared to the normal life insurance policies, general insurance policies function in a different method. insurance into a matter of real urgency. Insurance has developed exponentially since then and is now a highly complex and sophisticated response to risk. However, six core principles have been established over time – many of which have been upheld by the Courts or codified by Acts of Parliament.

When you think about the type of homes that need “homeowners insurance”, a big ole house in the suburbs is probably what springs to mind, but spacious family dwellings aren’t the only type of home that needs insurance. 2. Insurance - Classification of Insurance 1. Classification of Insurance• Life Insurance• Non Life Insurance 2. Classification of Insurance - Life• Life Insurance – It is a contract between the insured person and the company or "carrier" that is providing the insurance.

The principle of indemnity is such principle of insurance stating that an insured may not be compensated by the insurance company in an amount exceeding the insured’s economic loss. In type of insurance the insured would be compensation with the amount equivalent to the actual loss and not the amount exceeding the loss. six general types of insurance. Property Insurance; Property Insurance means that insurance companies provide certain security against the property of the person. Fire Insurance; Fire Insurance means protection of the stocks or products against the fire. If the business owner takes the fire insurance it helps them or secures him against the

six general types of insurance. Property Insurance; Property Insurance means that insurance companies provide certain security against the property of the person. Fire Insurance; Fire Insurance means protection of the stocks or products against the fire. If the business owner takes the fire insurance it helps them or secures him against the 1.4 what is general insurance 1.5 definition of insurance 1.6 difference between assurance and insurance 1.7 nature and charactristic of insurance 1.8 importance of insurance 1.9 function of insurance 1.10 advantages of insurance 1.11 terminologies used in insurance 1.12 basic principles of insurance 1.13 nature of insurance contract 1.14 classification of insurance 1.15 important aspects of

Most auto policies are for six months to a year. A basic auto insurance policy is comprised of six different kinds of coverage, each of which is priced separately (see below). 1. Bodily Injury Liability. This coverage applies to injuries that the policyholder and family members listed on the policy cause to someone else. These individuals are General insurance is basically an insurance policy that protects you against losses and damages other than those covered by life insurance. For more comprehensive coverage, it is vital for you to know about the risks covered to ensure that you and your family are protected from unforeseen losses.

CategoryTypes of insurance Wikipedia. General insurance includes Property Insurance, Liability Insurance, and Other Forms of Insurance. Fire and Marine Insurances are strictly called Property Insurance. Motor, Theft, Fidelity and Machine Insurances include the extent of liability insurance to a certain extent., study material professional programme insurance lawinsurance law and and practicepracticepractice module 3 elective paper 9.3 icsi house, 22, institutional area, lodi road, new delhi 110 003.

What are the different types of General Insurance Policies

General Insurance Types of General Insurance Bajaj Allianz. Chapter 1: Life Insurance In India 6 V) Minimizing Risk- Life cannot be compensated by anything but financial help in hard time can support anyone. An earning member in family wants to secure his family who are financially dependent and need life insurance., Principles of General Insurance Principles of Insurance 58 (b) In Motor Insurance: The type of vehicle, the purpose of its use, its age (Model), Cubic capacity and the fact that the driver has a consistently bad driving record. (c) In Marine Insurance: Type of packing, mode of carriage, name of carrier, nature of goods, the route..

Insurance Meaning World Finance

The 6 Types of Insurance You MUST Have. General Insurance in other words is a non-life insurance which insures everything excluding life. Health, Holiday, Accident, Travel, Mortgage Protection, etc are some of the aspects that General Insurance covers. As compared to the normal life insurance policies, general insurance policies function in a different method. https://en.wikipedia.org/wiki/Category:Types_of_insurance terms are also listed out. An overview of major life insurance and general insurance products is included as well. Contents Chapter 1: Risk Management: Provides an understanding of risk management - different types of risks - actual and consequential losses – management of risks – loss minimization techniques..

Different Types of Insurance Jermaine to make his him to City Hospital, but Lesson Objectives Examine the different types of insurance available. He did not mean to hit the Identify key terms associated with insurance and risks: natural disaster, liability, disability, deductibles, and risk management. General Insurance in other words is a non-life insurance which insures everything excluding life. Health, Holiday, Accident, Travel, Mortgage Protection, etc are some of the aspects that General Insurance covers. As compared to the normal life insurance policies, general insurance policies function in a different method.

Benefits from both life insurance and general insurance are significant not only for your peace of mind but the future of your family as well. The primary advantage is the cash value coverage during your life-time. Many individuals choose to buy insurance while they are still young since they can make use of its cash value by borrowing or Most auto policies are for six months to a year. A basic auto insurance policy is comprised of six different kinds of coverage, each of which is priced separately (see below). 1. Bodily Injury Liability. This coverage applies to injuries that the policyholder and family members listed on the policy cause to someone else. These individuals are

What Are the Six Principles of Insurance?. Each of the six principles of insurance defines a fundamental rule of action or conduct that addresses the legal side of the insurance industry. Each Insurance companies may sell any combination of insurance types, but are often classified into three groups: Life insurance companies, which sell life insurance, annuities and pensions products and bear similarities to asset management businesses; Non-life or property/casualty insurance companies, which sell other types of insurance.

Most auto policies are for six months to a year. A basic auto insurance policy is comprised of six different kinds of coverage, each of which is priced separately (see below). 1. Bodily Injury Liability. This coverage applies to injuries that the policyholder and family members listed on the policy cause to someone else. These individuals are Benefits from both life insurance and general insurance are significant not only for your peace of mind but the future of your family as well. The primary advantage is the cash value coverage during your life-time. Many individuals choose to buy insurance while they are still young since they can make use of its cash value by borrowing or

What is General Insurance? A general insurance is a contract that offers financial compensation on any loss other than death. It insures everything apart from life. A general insurance compensates you for financial loss due to liabilities related to your house, car, bike, health, travel, etc. The insurance company promises to pay you a sum What Are the Six Principles of Insurance?. Each of the six principles of insurance defines a fundamental rule of action or conduct that addresses the legal side of the insurance industry. Each

Types of Insurance Companies: Insurance companies can be categorized into two main divisions which are as follows: General Insurance Companies: These companies provide all types of insurance such as automobile, homeowner’s policies and many more. However, they do not cover life insurance. 24/01/2020 · Term insurance. Term plans are the most basic type of life insurance.They provide life cover with no savings / profits component. They are the most affordable form of life insurance as premiums are cheaper compared to other life insurance plans.. Online term insurance plans provide pure risk cover, which explains the lower premiums.

six general types of insurance. Property Insurance; Property Insurance means that insurance companies provide certain security against the property of the person. Fire Insurance; Fire Insurance means protection of the stocks or products against the fire. If the business owner takes the fire insurance it helps them or secures him against the Insurance companies may sell any combination of insurance types, but are often classified into three groups: Life insurance companies, which sell life insurance, annuities and pensions products and bear similarities to asset management businesses; Non-life or property/casualty insurance companies, which sell other types of insurance.

terms are also listed out. An overview of major life insurance and general insurance products is included as well. Contents Chapter 1: Risk Management: Provides an understanding of risk management - different types of risks - actual and consequential losses – management of risks – loss minimization techniques. The principle of indemnity is such principle of insurance stating that an insured may not be compensated by the insurance company in an amount exceeding the insured’s economic loss. In type of insurance the insured would be compensation with the amount equivalent to the actual loss and not the amount exceeding the loss.

2. Insurance - Classification of Insurance 1. Classification of Insurance• Life Insurance• Non Life Insurance 2. Classification of Insurance - Life• Life Insurance – It is a contract between the insured person and the company or "carrier" that is providing the insurance. Six Principles of Insurance 1. Six Principles Of Insurance Each of the six principles of insurance defines a fundamental rule of action or conduct that represents the legal side of the insurance industry. In total, they make up legal, binding guidelines for entering into an insurance contract and for preparing, lodging and managing lawful

When taking out insurance, policyholders often think more about their own needs than the risk the insurer takes on. But the insurer is all too aware of it. For that reason, there are six principles in place that guide all insurance companies as they make decisions about the policies they grant. However, after the entry of the private operators and aggressive marketing by few players this kind of policies are becoming popular. The premium on such type of policies is comparatively quite low when compared with other types of life insurance policies, mainly due to the fact that these policies do not carry cash value.

Principles of General Insurance Principles of Insurance 58 (b) In Motor Insurance: The type of vehicle, the purpose of its use, its age (Model), Cubic capacity and the fact that the driver has a consistently bad driving record. (c) In Marine Insurance: Type of packing, mode of carriage, name of carrier, nature of goods, the route. 5. Miscellaneous Insurance :Insurance Pdf -Types Of Insurance, Scope Of Insurance ,Classification . The process of fast development in the society gave rise to a number of risk or hazards. To provide security against such hazards, many other types of insurance also have been developed.

View and Download Meridian Explorer user manual online. Explorer Media Converter pdf manual download. Media Converter Meridian 563 User Manual (20 pages) Media Converter Meridian 263 delta sigma User Manual (23 pages) Media Converter Meridian 221 Specification Sheet. Media player digital link 2-channel a/d & digital format converter (2 pages) Media Converter Meridian 607 User Manual Meridian energy pen user manual pdf Rockingham meridian energy pen, jual meridian energy pen, meridian energy meridians pen, meridian energy pen user manual pdf, electronic acupuncture pen meridian energy massager pain therapy, Published in: Health & Medicine. 0 Comments 0 Likes Statistics

IC 01 PRINCIPLES OF INSURANCE Objectives Contents

What are the different types of General Insurance Policies. Benefits from both life insurance and general insurance are significant not only for your peace of mind but the future of your family as well. The primary advantage is the cash value coverage during your life-time. Many individuals choose to buy insurance while they are still young since they can make use of its cash value by borrowing or, What Are the Six Principles of Insurance?. Each of the six principles of insurance defines a fundamental rule of action or conduct that addresses the legal side of the insurance industry. Each.

Top General Insurance Policies Maps of India

CHAPTER 1. Principles of General Insurance Principles of Insurance 58 (b) In Motor Insurance: The type of vehicle, the purpose of its use, its age (Model), Cubic capacity and the fact that the driver has a consistently bad driving record. (c) In Marine Insurance: Type of packing, mode of carriage, name of carrier, nature of goods, the route., When taking out insurance, policyholders often think more about their own needs than the risk the insurer takes on. But the insurer is all too aware of it. For that reason, there are six principles in place that guide all insurance companies as they make decisions about the policies they grant..

Insurance companies may sell any combination of insurance types, but are often classified into three groups: Life insurance companies, which sell life insurance, annuities and pensions products and bear similarities to asset management businesses; Non-life or property/casualty insurance companies, which sell other types of insurance. It is different from all other types of insurances (i.e. general insurance), in that it is a sort of investment. Under a contract of life insurance, there is a guarantee on the part of the insurance company to pay a fixed amount to the assured (if he is alive) or to his beneficiaries; because death against which insurance is affected is sure to

In the United States, the most common types of personal insurance are homeowners, auto, health and life. Some types of insurance are required by law, such as auto insurance. The biggest advantage of insurance is that it serves as a hedge against future losses, but … Benefits from both life insurance and general insurance are significant not only for your peace of mind but the future of your family as well. The primary advantage is the cash value coverage during your life-time. Many individuals choose to buy insurance while they are still young since they can make use of its cash value by borrowing or

In the United States, the most common types of personal insurance are homeowners, auto, health and life. Some types of insurance are required by law, such as auto insurance. The biggest advantage of insurance is that it serves as a hedge against future losses, but … Most auto policies are for six months to a year. A basic auto insurance policy is comprised of six different kinds of coverage, each of which is priced separately (see below). 1. Bodily Injury Liability. This coverage applies to injuries that the policyholder and family members listed on the policy cause to someone else. These individuals are

study material professional programme insurance lawinsurance law and and practicepracticepractice module 3 elective paper 9.3 icsi house, 22, institutional area, lodi road, new delhi 110 003 1.4 what is general insurance 1.5 definition of insurance 1.6 difference between assurance and insurance 1.7 nature and charactristic of insurance 1.8 importance of insurance 1.9 function of insurance 1.10 advantages of insurance 1.11 terminologies used in insurance 1.12 basic principles of insurance 1.13 nature of insurance contract 1.14 classification of insurance 1.15 important aspects of

Benefits from both life insurance and general insurance are significant not only for your peace of mind but the future of your family as well. The primary advantage is the cash value coverage during your life-time. Many individuals choose to buy insurance while they are still young since they can make use of its cash value by borrowing or 2. Insurance - Classification of Insurance 1. Classification of Insurance• Life Insurance• Non Life Insurance 2. Classification of Insurance - Life• Life Insurance – It is a contract between the insured person and the company or "carrier" that is providing the insurance.

When you think about the type of homes that need “homeowners insurance”, a big ole house in the suburbs is probably what springs to mind, but spacious family dwellings aren’t the only type of home that needs insurance. Life Insurance, General Insurance. The marine insurance is considered as the oldest form of insurance. Travelers by sea and land were very much exposed to the risk of losing their vessels and merchandise because the piracy on the open seas and highway robbery of caravans were very common.

Different Types of Insurance Jermaine to make his him to City Hospital, but Lesson Objectives Examine the different types of insurance available. He did not mean to hit the Identify key terms associated with insurance and risks: natural disaster, liability, disability, deductibles, and risk management. When taking out insurance, policyholders often think more about their own needs than the risk the insurer takes on. But the insurer is all too aware of it. For that reason, there are six principles in place that guide all insurance companies as they make decisions about the policies they grant.

30/07/2014 · The specific general insurance cover can protect the economic value of the asset and prevent huge financial loses. For example, a home insurance policy can protect your home and the valuables inside from calamities and theft. In this article, we look at the different types of general insurance policies and the cover they provide. Two general types are available: term insurance Life insurance with a death benefit but no accumulated savings. provides coverage only during the term of the policy and pays off only on the insured’s death; whole-life insurance Provides savings as well as insurance and can let the insured collect before death. provides savings as well as

What is General Insurance? A general insurance is a contract that offers financial compensation on any loss other than death. It insures everything apart from life. A general insurance compensates you for financial loss due to liabilities related to your house, car, bike, health, travel, etc. The insurance company promises to pay you a sum However, after the entry of the private operators and aggressive marketing by few players this kind of policies are becoming popular. The premium on such type of policies is comparatively quite low when compared with other types of life insurance policies, mainly due to the fact that these policies do not carry cash value.

Two general types are available: term insurance Life insurance with a death benefit but no accumulated savings. provides coverage only during the term of the policy and pays off only on the insured’s death; whole-life insurance Provides savings as well as insurance and can let the insured collect before death. provides savings as well as Pages in category "Types of insurance" The following 91 pages are in this category, out of 91 total. This list may not reflect recent changes ().

Auto Insurance Basics III

General Insurance Buy & Renew General Insurance Policies. Different Types of Insurance Jermaine to make his him to City Hospital, but Lesson Objectives Examine the different types of insurance available. He did not mean to hit the Identify key terms associated with insurance and risks: natural disaster, liability, disability, deductibles, and risk management., In general, there are 2 major types of insurance - general insurance and life insurance. However, some other types of insurance are available as well. In India life insurance is the most availed form along with health and accident based plans. Insurance Policies - Categorization. General Insurance Personal Insurance Rural Insurance.

Six Principles of Insurance SlideShare. Read all about What are the different types of General Insurance Policies? at SecureNow InsuroPedia - One of the leading sources for General Insurance and other insurance related information., In general, there are 2 major types of insurance - general insurance and life insurance. However, some other types of insurance are available as well. In India life insurance is the most availed form along with health and accident based plans. Insurance Policies - Categorization. General Insurance Personal Insurance Rural Insurance.

Types of Homeowners Insurance policygenius.com

Types of insurance Citizens Advice. 24/01/2020В В· Term insurance. Term plans are the most basic type of life insurance.They provide life cover with no savings / profits component. They are the most affordable form of life insurance as premiums are cheaper compared to other life insurance plans.. Online term insurance plans provide pure risk cover, which explains the lower premiums. https://en.wikipedia.org/wiki/General_insurance Insurance companies may sell any combination of insurance types, but are often classified into three groups: Life insurance companies, which sell life insurance, annuities and pensions products and bear similarities to asset management businesses; Non-life or property/casualty insurance companies, which sell other types of insurance..

General Insurance in other words is a non-life insurance which insures everything excluding life. Health, Holiday, Accident, Travel, Mortgage Protection, etc are some of the aspects that General Insurance covers. As compared to the normal life insurance policies, general insurance policies function in a different method. Six Principles of Insurance 1. Six Principles Of Insurance Each of the six principles of insurance defines a fundamental rule of action or conduct that represents the legal side of the insurance industry. In total, they make up legal, binding guidelines for entering into an insurance contract and for preparing, lodging and managing lawful

The six principles of insurance are something that every new insurance agent learns before getting an insurance sales license. These six tenets remind agents at all times of insurance industry standards. The six principles of insurance are basically a cheat sheet that should direct you at all times as an insurance … The six principles of insurance are something that every new insurance agent learns before getting an insurance sales license. These six tenets remind agents at all times of insurance industry standards. The six principles of insurance are basically a cheat sheet that should direct you at all times as an insurance …

terms are also listed out. An overview of major life insurance and general insurance products is included as well. Contents Chapter 1: Risk Management: Provides an understanding of risk management - different types of risks - actual and consequential losses – management of risks – loss minimization techniques. Life Insurance, General Insurance. The marine insurance is considered as the oldest form of insurance. Travelers by sea and land were very much exposed to the risk of losing their vessels and merchandise because the piracy on the open seas and highway robbery of caravans were very common.

When you think about the type of homes that need “homeowners insurance”, a big ole house in the suburbs is probably what springs to mind, but spacious family dwellings aren’t the only type of home that needs insurance. insurance into a matter of real urgency. Insurance has developed exponentially since then and is now a highly complex and sophisticated response to risk. However, six core principles have been established over time – many of which have been upheld by the Courts or codified by Acts of Parliament.

18.5 Types of Insurance Insurance, which is based on a contract, may be broadly classified into the following types. (i) Life Insurance (ii) Fire Insurance (iii) Marine Insurance, and (iv)Other types such as burglary insurance, motor vehicle insurance, etc. Until recently Life Insurance Corporation of India (LIC) and General Insurance Corporation Benefits from both life insurance and general insurance are significant not only for your peace of mind but the future of your family as well. The primary advantage is the cash value coverage during your life-time. Many individuals choose to buy insurance while they are still young since they can make use of its cash value by borrowing or

What is General Insurance? A general insurance is a contract that offers financial compensation on any loss other than death. It insures everything apart from life. A general insurance compensates you for financial loss due to liabilities related to your house, car, bike, health, travel, etc. The insurance company promises to pay you a sum The Life Insurance provides security against premature death and payment in old age to lead the comfortable life. Similarly in general Insurance, the property can be insured against any contingency i.e. fire, earthquake etc. (b) To provide Peace of Mind The uncertainty due to fire, accident, death, illness,

5. Miscellaneous Insurance :Insurance Pdf -Types Of Insurance, Scope Of Insurance ,Classification . The process of fast development in the society gave rise to a number of risk or hazards. To provide security against such hazards, many other types of insurance also have been developed. When you think about the type of homes that need “homeowners insurance”, a big ole house in the suburbs is probably what springs to mind, but spacious family dwellings aren’t the only type of home that needs insurance.

six general types of insurance. Property Insurance; Property Insurance means that insurance companies provide certain security against the property of the person. Fire Insurance; Fire Insurance means protection of the stocks or products against the fire. If the business owner takes the fire insurance it helps them or secures him against the General insurance or non-life insurance policies, including automobile and homeowners policies, provide payments depending on the loss from a particular financial event. General insurance is typically defined as any insurance that is not determined to be life insurance.It is called property and casualty insurance in the United States and Canada and non-life insurance in Continental Europe.

Read all about What are the different types of General Insurance Policies? at SecureNow InsuroPedia - One of the leading sources for General Insurance and other insurance related information. When you think about the type of homes that need “homeowners insurance”, a big ole house in the suburbs is probably what springs to mind, but spacious family dwellings aren’t the only type of home that needs insurance.

30/07/2014 · The specific general insurance cover can protect the economic value of the asset and prevent huge financial loses. For example, a home insurance policy can protect your home and the valuables inside from calamities and theft. In this article, we look at the different types of general insurance policies and the cover they provide. 2. Insurance - Classification of Insurance 1. Classification of Insurance• Life Insurance• Non Life Insurance 2. Classification of Insurance - Life• Life Insurance – It is a contract between the insured person and the company or "carrier" that is providing the insurance.

General Insurance in other words is a non-life insurance which insures everything excluding life. Health, Holiday, Accident, Travel, Mortgage Protection, etc are some of the aspects that General Insurance covers. As compared to the normal life insurance policies, general insurance policies function in a different method. study material professional programme insurance lawinsurance law and and practicepracticepractice module 3 elective paper 9.3 icsi house, 22, institutional area, lodi road, new delhi 110 003