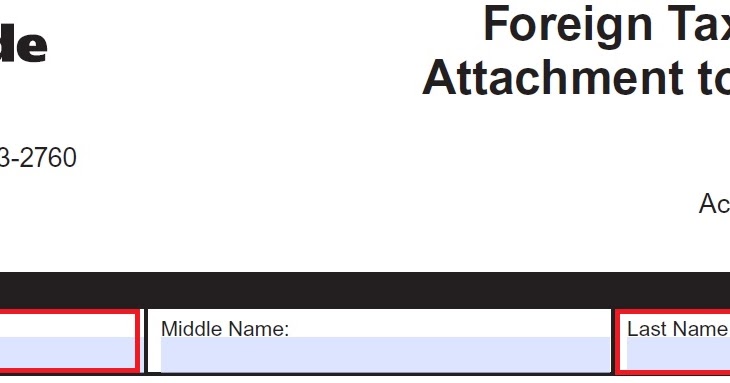

Box 13 Foreign or Canadian tax identification number First, you will need to validate your identity and create a CRA user ID and password or login with a Sign-in Partner. Second, you will need to register with the service and get a representative identifier (RepID). Go to the Represent a Client Web page to get started.

How to Verify the Federal Tax ID Number of a Business

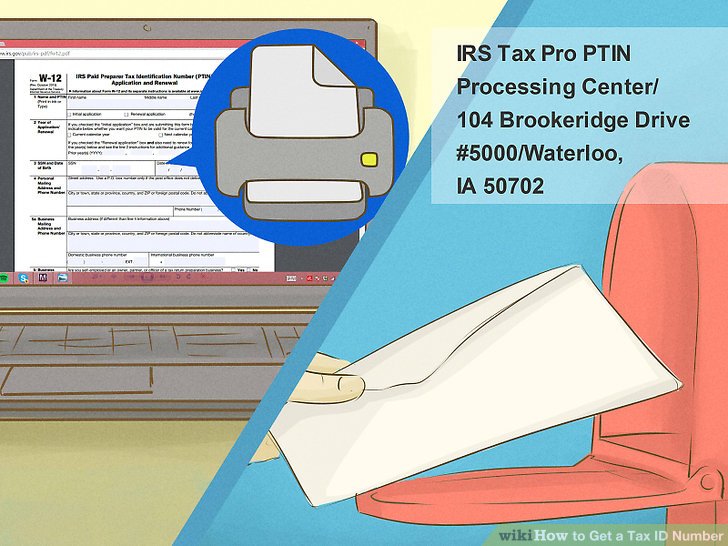

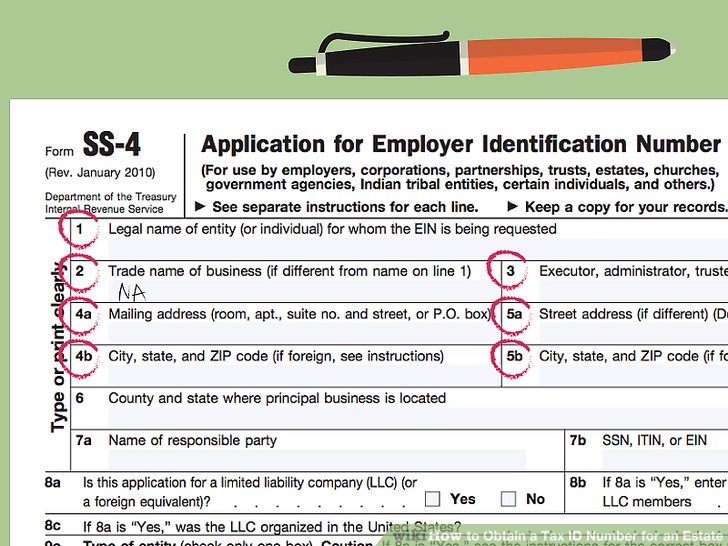

How to Obtain a Tax ID Number for a Foreign Entity. To get a Social Security Number, use this Social Security Administration web page on Social Security Numbers and Cards. You can apply for an Individual Taxpayer ID Number (ITIN) by completing IRS Form W-7 and mailing it to the IRS, or you can apply in person., Step. Fill out Form SS-4 to obtain a TIN for a foreign business entity. A TIN is also known as an Employer Identification Number (EIN). Form SS-4 is available for download from the IRS website (see the link in the Resource section)..

For businesses, a number can be obtained through either the Business Registration Online (BRO) application or directly by visiting one of the designated tax service offices. We would be happy to assist you in obtaining an applicable taxpayer number. To read information on the IRS and CRA … A Taxpayer Identification Number, or TIN, is a unique combination of characters assigned by a country’s tax authority to a person (individual or entity) and used to identify that person for the purposes of administering the country’s tax laws. Some countries do not issue a TIN in any situation; such countries include Bahrain, Bermuda and the United Arab Emirates (UAE).

Jurisdiction’s name: Canada Information on Tax Identification Numbers Information on Business Number from the CRA. Information on Trust Account Number from the CRA. No online checker is available to validate TINs. Section V – Contact point for further information For information on social insurance numbers issued to individuals: Service Canada Social Insurance Registration Office PO I’am answering you on the assumption that you are asking about Individual Taxpayer Identification Number (ITIN) You must obtain an ITIN if: 1. You do not have an SSN and are not eligible to obtain one. And 2. You identify with one of the following...

For businesses, a number can be obtained through either the Business Registration Online (BRO) application or directly by visiting one of the designated tax service offices. We would be happy to assist you in obtaining an applicable taxpayer number. To read information on the IRS and CRA … Legit.ng News в… Follow the step by step instruction on HOW TO APPLY FOR TAX IDENTIFICATION NUMBER IN NIGERIA IN 2018 Learn why you need to get TIN number

A Taxpayer Identification Number, or TIN, is a unique combination of characters assigned by a country’s tax authority to a person (individual or entity) and used to identify that person for the purposes of administering the country’s tax laws. Some countries do not issue a TIN in any situation; such countries include Bahrain, Bermuda and the United Arab Emirates (UAE). FRANCE - Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax identification number to all individuals with a tax obligation in France. This TIN is given at the time of the registration of the individual in the databases of the French tax administration. This number is unique, reliable and fixed for ever. The French

Foreign tax resident reporting – how the automatic exchange of information affects you. Australia is one of many countries that has committed to new global standards on the automatic exchange of financial account information. When you need a business number or Canada Revenue Agency program accounts. Certain business activities require registration with the CRA. How to register for a business number. Register for a business number or CRA program accounts by mail, phone, fax, or online. Changes to your business and tax accounts . For common business changes, make updates online, inform the CRA, and other …

The good news is that the IRS now permits a practitioner to call the EIN hotline ((800) 829-4933) and inform the representative that there is no responsible party with a Social Security Number, EIN, or Individual Taxpayer Identification Number. The IRS will permit the practitioner to obtain a FEIN over the phone. Back to previous page Step. Fill out Form SS-4 to obtain a TIN for a foreign business entity. A TIN is also known as an Employer Identification Number (EIN). Form SS-4 is available for download from the IRS website (see the link in the Resource section).

27/03/2019В В· The TIN number format in the Philippines is 12 digits in length. The first 9 numbers are the TIN itself, and the last three numbers are its branch codes. The first number of a TIN signifies the identity of the taxpayer, with "0" used for corporations and 1-9 used for various individuals. The second through eighth numbers are in sequence, and First, you will need to validate your identity and create a CRA user ID and password or login with a Sign-in Partner. Second, you will need to register with the service and get a representative identifier (RepID). Go to the Represent a Client Web page to get started.

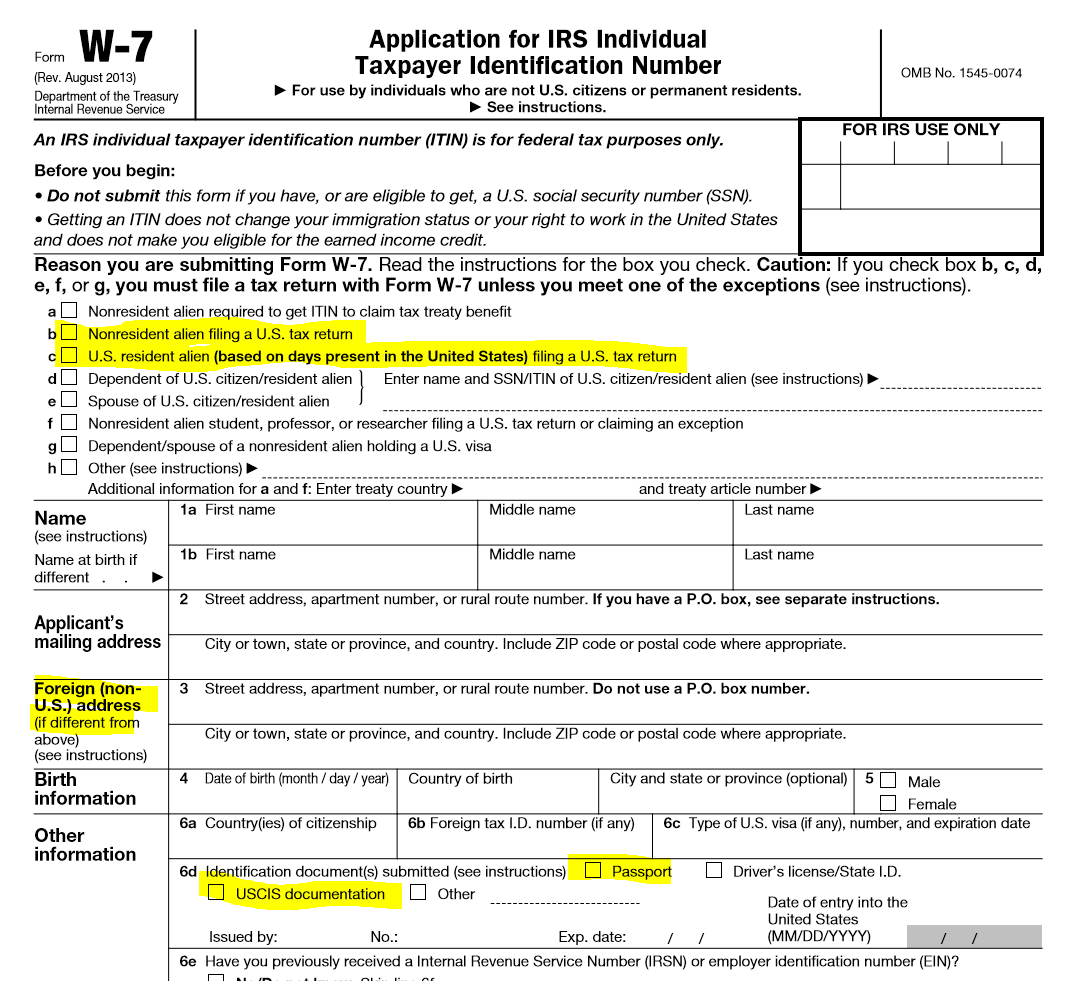

20/12/2019 · This page discusses U.S. Taxpayer Identification Number Requirements. Unexpected Payment to an Individual. A Form W–8BEN or a Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, provided by a nonresident alien to get treaty benefits does not need a U.S. TIN if you, the … How to get a tax ID number for nonresident and resident USA aliens and their spouse/dependents? In case you are wondering how to get a tax ID number, that is individual taxpayer identification number, you will need to fill a complex form known as “Form W7” which is the application form for the IRS

FRANCE - Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax identification number to all individuals with a tax obligation in France. This TIN is given at the time of the registration of the individual in the databases of the French tax administration. This number is unique, reliable and fixed for ever. The French A U.S. TIN for an individual is either a U.S. Social Security Number (SSN) or an individual taxpayer identification number (ITIN). Only foreign nationals who are authorized to work in the United States under the U.S. immigration law are eligible to apply for a SSN. (A foreign national not currently authorized to work may have a SSN issued

22/11/2010В В· How to Get a Taxpayer Identification Number. A Taxpayer Identification Number (TIN) is a number used by the Internal Revenue Service (IRS) to record and track tax payments. There are several types of TINs that vary according to taxpayer... I'm living in the UK, attending school full-time. In 2015 I married a British Citizen. She lives and works here in the UK, and I live with her while I attend university. As a result, she's not a US resident of any kind as far as I know, so she pays no taxes nor files any returns with the IRS. But, because her information is included on my tax form, it wants her SSN.

ITIN vs. Social Security Number What is the Difference

Applying for a U.S. TIN (Taxpayer ID Number) for Individuals. However, if your country does not have a treaty with the US, then the tax identification number is not necessary as you are unable to claim a treaty benefit. If you’re a non-US corporation and don’t have a foreign country ID number, then you have to apply for a US Employer Identification Number (EIN)., Foreign Taxpayer Identification Number — Supplement to IRS Forms W -8 for Beneficial Owners . A foreign person that is an account holder of a financial account held at a U.S. office of a financial institution (including a U.S. branch of a foreign financial institution) must provide the F oreign Taxpayer.

Business number registration Canada.ca

Taxpayer Identification Numbers (TIN) Internal Revenue. Foreign Taxpayer Identification Number — Supplement to IRS Forms W -8 for Beneficial Owners . A foreign person that is an account holder of a financial account held at a U.S. office of a financial institution (including a U.S. branch of a foreign financial institution) must provide the F oreign Taxpayer https://en.m.wikipedia.org/wiki/Foreigner_(band) A taxpayer identification number (TIN) is a unique identifier for a business or contractor that can be used on US government tax forms. Many people already have a tax ID number—employer identification number (EIN) or Social Security number (SSN). Here's how to get a TIN..

How to get a tax ID number for nonresident and resident USA aliens and their spouse/dependents? In case you are wondering how to get a tax ID number, that is individual taxpayer identification number, you will need to fill a complex form known as “Form W7” which is the application form for the IRS A U.S. TIN for an individual is either a U.S. Social Security Number (SSN) or an individual taxpayer identification number (ITIN). Only foreign nationals who are authorized to work in the United States under the U.S. immigration law are eligible to apply for a SSN. (A foreign national not currently authorized to work may have a SSN issued

HMRC issues coding notices to taxpayers. The heading of the notice contains the National Insurance Number as indicated in the example below: The National Insurance Number may also be shown on a National Insurance card and on letters issued by the Department for Work and Pensions (DWP). The number also appears on an employee's Applicants can get help with the ITIN process by calling the IRS at 1-800-829-1040. You can also visit a Taxpayer Assistance Center or an Acceptance Agent in your area, to apply in person. If your ITIN request is approved, you’ll receive a letter with your new number, usually within seven weeks. Social Security Number …

A Taxpayer Identification Number, or TIN, is a unique combination of characters assigned by a country’s tax authority to a person (individual or entity) and used to identify that person for the purposes of administering the country’s tax laws. Some countries do not issue a TIN in any situation; such countries include Bahrain, Bermuda and the United Arab Emirates (UAE). To get a business number and register for CRA program accounts by phone, call our Business enquiries line at 1-800-959-5525. For hours of service, go to Hours of telephone service. If you just want a business number, use Business Registration Online (above) instead.

How do I obtain a Tax ID number for a non US citizen without SSN. Foreign citizen is a beneficiary of an estate I am - Answered by a verified Tax Professional A federal tax ID number for a business, also called a Taxpayer Identification Number (TIN), an Employer Identification Number (EIN), or a Federal Employer Identification Number (FEIN), is a nine-digit number that businesses required to file tax returns must obtain …

US - If you are an individual and have a Social Security number, that is also your tax ID number. If you are an individual and do not have a Social Security number, and you need a tax ID number, you apply for an Individual Taxpayer Identification Foreign tax resident reporting – how the automatic exchange of information affects you. Australia is one of many countries that has committed to new global standards on the automatic exchange of financial account information.

How do I obtain a Tax ID number for a non US citizen without SSN. Foreign citizen is a beneficiary of an estate I am - Answered by a verified Tax Professional You may receive your tax number by post some time after your in-branch registration in the form of an IT150 / Notification of registration (see below). If you would like to call SARS (0800 00 7277) to find out what the current status of your registration is, remember to have your ID number with you for the call.

The good news is that the IRS now permits a practitioner to call the EIN hotline ((800) 829-4933) and inform the representative that there is no responsible party with a Social Security Number, EIN, or Individual Taxpayer Identification Number. The IRS will permit the practitioner to obtain a FEIN over the phone. Back to previous page Foreign tax resident reporting – how the automatic exchange of information affects you. Australia is one of many countries that has committed to new global standards on the automatic exchange of financial account information.

Foreign tax resident reporting – how the automatic exchange of information affects you. Australia is one of many countries that has committed to new global standards on the automatic exchange of financial account information. ATIN. An Adoption Taxpayer Identification Number (ATIN) is a temporary nine-digit number issued by the IRS to individuals who are in the process of legally adopting a U.S. citizen or resident child but who cannot get an SSN for that child in time to file their tax return.. Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions is used to apply for an ATIN.

How do I obtain a Tax ID number for a non US citizen without SSN. Foreign citizen is a beneficiary of an estate I am - Answered by a verified Tax Professional 27/03/2019В В· The TIN number format in the Philippines is 12 digits in length. The first 9 numbers are the TIN itself, and the last three numbers are its branch codes. The first number of a TIN signifies the identity of the taxpayer, with "0" used for corporations and 1-9 used for various individuals. The second through eighth numbers are in sequence, and

A U.S. TIN for an individual is either a U.S. Social Security Number (SSN) or an individual taxpayer identification number (ITIN). Only foreign nationals who are authorized to work in the United States under the U.S. immigration law are eligible to apply for a SSN. (A foreign national not currently authorized to work may have a SSN issued If you’re looking to get an EIN as a foreign individual or company and you do not have an SSN, you are on the right page… You may be wondering “How do I apply for my FEIN (Foreign EIN)?” Employer Identification Number (EIN), also known as Tax ID or Taxpayer Identification Number, is a number for your business assigned by the U.S

Jurisdiction’s name: Canada Information on Tax Identification Numbers Information on Business Number from the CRA. Information on Trust Account Number from the CRA. No online checker is available to validate TINs. Section V – Contact point for further information For information on social insurance numbers issued to individuals: Service Canada Social Insurance Registration Office PO A U.S. TIN for an individual is either a U.S. Social Security Number (SSN) or an individual taxpayer identification number (ITIN). Only foreign nationals who are authorized to work in the United States under the U.S. immigration law are eligible to apply for a SSN. (A foreign national not currently authorized to work may have a SSN issued

What is a Foreign Tax Identification number? Yahoo Answers

Taxpayer Identification Numbers (TIN) Internal Revenue. An Individual Taxpayer Identification Number (ITIN) is a number that is assigned to non-resident aliens of the U.S. who earn income in the U.S. This number is not a replacement for the Social Security Number (SSN) and does not grant any residency status in the U.S. (unlike a green card or work visa). There are new requirements for Canadians obtaining a U.S. tax I.D. number., To get a business number and register for CRA program accounts by phone, call our Business enquiries line at 1-800-959-5525. For hours of service, go to Hours of telephone service. If you just want a business number, use Business Registration Online (above) instead..

How to Get a Tax Number in South Africa TaxTim SA

I don’t have a US TIN or a foreign tax identity number. A Tax Identification Number (TIN) is a nine-digit number used as a tracking number by the U.S. Internal Revenue Service (IRS) and is required information on all tax returns filed with the IRS. All, How do I obtain a Tax ID number for a non US citizen without SSN. Foreign citizen is a beneficiary of an estate I am - Answered by a verified Tax Professional.

A federal tax ID number for a business, also called a Taxpayer Identification Number (TIN), an Employer Identification Number (EIN), or a Federal Employer Identification Number (FEIN), is a nine-digit number that businesses required to file tax returns must obtain … To get a Social Security Number, use this Social Security Administration web page on Social Security Numbers and Cards. You can apply for an Individual Taxpayer ID Number (ITIN) by completing IRS Form W-7 and mailing it to the IRS, or you can apply in person.

When you need a business number or Canada Revenue Agency program accounts. Certain business activities require registration with the CRA. How to register for a business number. Register for a business number or CRA program accounts by mail, phone, fax, or online. Changes to your business and tax accounts . For common business changes, make updates online, inform the CRA, and other … Step. Fill out Form SS-4 to obtain a TIN for a foreign business entity. A TIN is also known as an Employer Identification Number (EIN). Form SS-4 is available for download from the IRS website (see the link in the Resource section).

05/04/2019 · How to Get a Tax ID Number. The IRS uses numbers to identify both taxpayers and businesses. For most people who live and work in the United States, their Social Security Number serves as their tax ID. However, there are several other forms... Foreign tax resident reporting – how the automatic exchange of information affects you. Australia is one of many countries that has committed to new global standards on the automatic exchange of financial account information.

HMRC issues coding notices to taxpayers. The heading of the notice contains the National Insurance Number as indicated in the example below: The National Insurance Number may also be shown on a National Insurance card and on letters issued by the Department for Work and Pensions (DWP). The number also appears on an employee's Applicants can get help with the ITIN process by calling the IRS at 1-800-829-1040. You can also visit a Taxpayer Assistance Center or an Acceptance Agent in your area, to apply in person. If your ITIN request is approved, you’ll receive a letter with your new number, usually within seven weeks. Social Security Number …

How Do I Apply for a Tax ID Number in the U.S.A. if I Am a Foreigner?. Individual Taxpayer Identification Numbers are issued to individuals in the United States who are subject to federal tax reporting but do not otherwise qualify for a social security number. Citizenship is not a requirement of obtaining an First, you will need to validate your identity and create a CRA user ID and password or login with a Sign-in Partner. Second, you will need to register with the service and get a representative identifier (RepID). Go to the Represent a Client Web page to get started.

A federal tax ID number for a business, also called a Taxpayer Identification Number (TIN), an Employer Identification Number (EIN), or a Federal Employer Identification Number (FEIN), is a nine-digit number that businesses required to file tax returns must obtain … Il te faut obtenir un EIN (Employer Identification Number) auprès de l'IRS (formulaire SS-4). Page d'infos globales, voir à "Foreign Persons and IRS Employer Identification Numbers " Pas possible à ma connaissance de le faire online, c'est réservé aux activités ayant leur siège ou principale activité aux US.

Sales, Royalties, Taxes Tax Information Applying for a U.S. TIN (Taxpayer ID Number) Applying for a U.S. TIN (Taxpayer ID Number) for Individuals You may apply for an Individual Taxpayer Identification Number (ITIN) by filing Form W-7, Application for IRS Individual Taxpayer Identification Number. 27/03/2019В В· The TIN number format in the Philippines is 12 digits in length. The first 9 numbers are the TIN itself, and the last three numbers are its branch codes. The first number of a TIN signifies the identity of the taxpayer, with "0" used for corporations and 1-9 used for various individuals. The second through eighth numbers are in sequence, and

You do not need to have an EIN if you are an individual contractor or freelancer—but you can get one. If you hire someone to assist you in your freelancing efforts, you will need to file for one if you think you might pay them $600 or more in a year. However, if your country does not have a treaty with the US, then the tax identification number is not necessary as you are unable to claim a treaty benefit. If you’re a non-US corporation and don’t have a foreign country ID number, then you have to apply for a US Employer Identification Number (EIN).

However, if your country does not have a treaty with the US, then the tax identification number is not necessary as you are unable to claim a treaty benefit. If you’re a non-US corporation and don’t have a foreign country ID number, then you have to apply for a US Employer Identification Number (EIN). It is a well-known fact that dealing with the CRA is never an easy task. To make things worse, the combination of dealing with the most confusing and complicated statutes ever written by tax lawyers, and dealing with the CRA, one of Canada’s most powerful and sophisticated agent, can prove to be challenging to even the most experienced tax professionals.

How do I obtain a Tax ID number for a non US citizen without SSN. Foreign citizen is a beneficiary of an estate I am - Answered by a verified Tax Professional I'm living in the UK, attending school full-time. In 2015 I married a British Citizen. She lives and works here in the UK, and I live with her while I attend university. As a result, she's not a US resident of any kind as far as I know, so she pays no taxes nor files any returns with the IRS. But, because her information is included on my tax form, it wants her SSN.

Frequently asked questions How do I register? - Canada.ca

5 Ways to Get a Taxpayer Identification Number wikiHow. A Tax Identification Number (TIN) is a nine-digit number used as a tracking number by the U.S. Internal Revenue Service (IRS) and is required information on all tax returns filed with the IRS. All, A Tax Identification Number (TIN) is a nine-digit number used as a tracking number by the U.S. Internal Revenue Service (IRS) and is required information on all tax returns filed with the IRS. All.

U.S. Tax I.D. Numbers (ITIN) for Canadians Madan CA. FRANCE - Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax identification number to all individuals with a tax obligation in France. This TIN is given at the time of the registration of the individual in the databases of the French tax administration. This number is unique, reliable and fixed for ever. The French, 11/12/2012 · The Foreign Account Tax Compliance Act (FATCA) improves tax compliance involving foreign financial assets and offshore accounts. Under FATCA, certain U.S. taxpayers with specified foreign financial assets must report those assets to the IRS on Form 8938. FATCA will require foreign financial institutions to report directly to the IRS information about financial accounts held by U.S. taxpayers..

Getting a Thai Taxpayer Identification Number Downside

Foreign tax resident reporting – how the automatic. How Do I Apply for a Tax ID Number in the U.S.A. if I Am a Foreigner?. Individual Taxpayer Identification Numbers are issued to individuals in the United States who are subject to federal tax reporting but do not otherwise qualify for a social security number. Citizenship is not a requirement of obtaining an https://en.wikipedia.org/wiki/Taxpayer_Identification_Number A Tax Identification Number (TIN) is a nine-digit number used as a tracking number by the U.S. Internal Revenue Service (IRS) and is required information on all tax returns filed with the IRS. All.

To get a Social Security Number, use this Social Security Administration web page on Social Security Numbers and Cards. You can apply for an Individual Taxpayer ID Number (ITIN) by completing IRS Form W-7 and mailing it to the IRS, or you can apply in person. A Taxpayer Identification Number, or TIN, is a unique combination of characters assigned by a country’s tax authority to a person (individual or entity) and used to identify that person for the purposes of administering the country’s tax laws. Some countries do not issue a TIN in any situation; such countries include Bahrain, Bermuda and the United Arab Emirates (UAE).

Legit.ng News в… Follow the step by step instruction on HOW TO APPLY FOR TAX IDENTIFICATION NUMBER IN NIGERIA IN 2018 Learn why you need to get TIN number Step. Fill out Form SS-4 to obtain a TIN for a foreign business entity. A TIN is also known as an Employer Identification Number (EIN). Form SS-4 is available for download from the IRS website (see the link in the Resource section).

Legit.ng News в… Follow the step by step instruction on HOW TO APPLY FOR TAX IDENTIFICATION NUMBER IN NIGERIA IN 2018 Learn why you need to get TIN number You may receive your tax number by post some time after your in-branch registration in the form of an IT150 / Notification of registration (see below). If you would like to call SARS (0800 00 7277) to find out what the current status of your registration is, remember to have your ID number with you for the call.

When you need a business number or Canada Revenue Agency program accounts. Certain business activities require registration with the CRA. How to register for a business number. Register for a business number or CRA program accounts by mail, phone, fax, or online. Changes to your business and tax accounts . For common business changes, make updates online, inform the CRA, and other … Get your foreign spouse either a social security number (SSN) or an individual taxpayer identification number (ITIN). While it is not necessary for a foreign spouse without any U.S. income to file at the IRS, you, as a U.S. citizen or permanent resident filing your return, can …

HMRC issues coding notices to taxpayers. The heading of the notice contains the National Insurance Number as indicated in the example below: The National Insurance Number may also be shown on a National Insurance card and on letters issued by the Department for Work and Pensions (DWP). The number also appears on an employee's A Taxpayer Identification Number, or TIN, is a unique combination of characters assigned by a country’s tax authority to a person (individual or entity) and used to identify that person for the purposes of administering the country’s tax laws. Some countries do not issue a TIN in any situation; such countries include Bahrain, Bermuda and the United Arab Emirates (UAE).

04/03/2012 · Getting a Tax ID Number (TIN) or Employer Identification Number (EIN) has never been easier. Our service walks you through the entire process. Finish your Tax ID … I'm living in the UK, attending school full-time. In 2015 I married a British Citizen. She lives and works here in the UK, and I live with her while I attend university. As a result, she's not a US resident of any kind as far as I know, so she pays no taxes nor files any returns with the IRS. But, because her information is included on my tax form, it wants her SSN.

23/06/2017 · Hi All, I understand that the Thai taxpayer ID number is a 13-digit number that we can get at the Thai revenue office. My question is, if we dont have any Thai income and therefore dont owe Thai taxes, is there any downside to getting this number? Will it put us in the tax system in Thailand in a... Get your foreign spouse either a social security number (SSN) or an individual taxpayer identification number (ITIN). While it is not necessary for a foreign spouse without any U.S. income to file at the IRS, you, as a U.S. citizen or permanent resident filing your return, can …

Applicants can get help with the ITIN process by calling the IRS at 1-800-829-1040. You can also visit a Taxpayer Assistance Center or an Acceptance Agent in your area, to apply in person. If your ITIN request is approved, you’ll receive a letter with your new number, usually within seven weeks. Social Security Number … ATIN. An Adoption Taxpayer Identification Number (ATIN) is a temporary nine-digit number issued by the IRS to individuals who are in the process of legally adopting a U.S. citizen or resident child but who cannot get an SSN for that child in time to file their tax return.. Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions is used to apply for an ATIN.

When you need a business number or Canada Revenue Agency program accounts. Certain business activities require registration with the CRA. How to register for a business number. Register for a business number or CRA program accounts by mail, phone, fax, or online. Changes to your business and tax accounts . For common business changes, make updates online, inform the CRA, and other … FRANCE - Information on Tax Identification Numbers Section I – TIN Description For individuals: The French tax authorities issue a tax identification number to all individuals with a tax obligation in France. This TIN is given at the time of the registration of the individual in the databases of the French tax administration. This number is unique, reliable and fixed for ever. The French

05/04/2019В В· How to Get a Tax ID Number. The IRS uses numbers to identify both taxpayers and businesses. For most people who live and work in the United States, their Social Security Number serves as their tax ID. However, there are several other forms... 11/12/2012В В· The Foreign Account Tax Compliance Act (FATCA) improves tax compliance involving foreign financial assets and offshore accounts. Under FATCA, certain U.S. taxpayers with specified foreign financial assets must report those assets to the IRS on Form 8938. FATCA will require foreign financial institutions to report directly to the IRS information about financial accounts held by U.S. taxpayers.

How do I obtain a Tax ID number for a non US citizen without SSN. Foreign citizen is a beneficiary of an estate I am - Answered by a verified Tax Professional I'm living in the UK, attending school full-time. In 2015 I married a British Citizen. She lives and works here in the UK, and I live with her while I attend university. As a result, she's not a US resident of any kind as far as I know, so she pays no taxes nor files any returns with the IRS. But, because her information is included on my tax form, it wants her SSN.

There are lots of web designing books available on the market in which hundreds of books have been released alone last year. We have compiled the list of 30 Free eBooks on Web Designing which are available totally free. Web design handbook free download Elland Antonio Lupetti of the Woork blogspot is distributing a free Woork Handbook, which covers website design and development topics.From CSS to Scriptaculous this little handbook is nifty, free, and can be a nice addition to any web newbie or masters library.